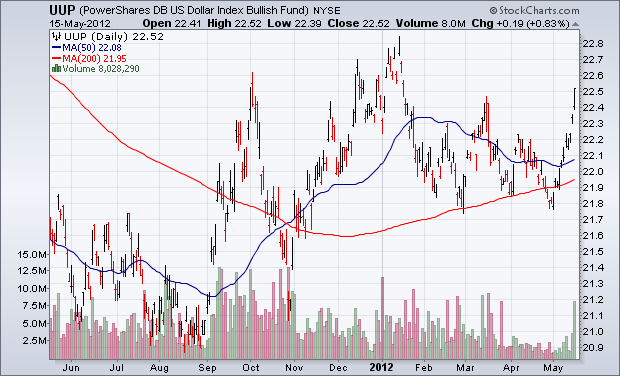

Charts Are Breaking Down All Over.

They say a picture is

worth a 1,000 words, so here are 4,000 words worth. The good people at www.stockcharts.com put together this

series of charts establishing beyond any reasonable doubt that the “RISK ON”

trade is breaking down across all asset classes.

Everything is breaking

down, simultaneously and in unison, including the S&P 500 (SPX), Gold

(GLD), Silver (SLV), Oil (USO), Copper (CU), the Euro (FXE), the Australian

dollar (FXA), and the Canadian dollar (FXC). In the meantime, Treasury bonds

(TLT), (TBT) are moving from strength to strength.

The news from Europe can

only get worse. An American recession, considered impossible by strategists

only a month ago, is now looming large as their economic data continues to

deteriorate. The flight to safety has exploded into a stampede, driving the US

dollar index up 12 consecutive days, a new record.

If these charts continue

to break down, as the news flow dictates they should, here are some downside targets which could be met pretty rapidly:

(SPX) 1,280

($INDU) 12,200

(IWM) $70

(FXE) $126

(FXA) $95

(GLD) $150

(SLV) $25

(USO) $32

(CU) $22

No comments:

Post a Comment