Friday, March 30, 2012

Update: ARM:LSE

MY short trade on ARM : LSE is still running though It has not developed as I had hoped. The price action broke the wedge which filled my order (the green circle). The price then re-entered the wedge and run upwards, coming very close to my stop loss order(the red circle). However the price has subsequently retraced and is now back up against a support level at 587p. I need the price to break down through this level. either way! It could go either way. Notably, the price has been making higher highs but my macd indicator has not made higher highs. This should be a bearish indication for the price. The duration of this pattern on the hourly chart was 116 bars...I have been in the trade for 45 bars so I will allow it to run and monitor it along the way. As such, I continue to watch and wait.

Friday, March 23, 2012

New short trade ARM:LSE

I have entered a new short trade on ARM Holdings, ARM:LSE.

The 4 hour chart is showing that the price has respected the Fibonacci .618 retracement of the most recent swing and my momentum indicator is rolling over.

The hourly chart shows a clear rising wedge and I have entered at the bottom of the wedge, at the first re-test of the trend line after the price broke through. My macd indicator is showing a bearish divergence with price.

My stop is just outside the top of the wedge and I've placed my first target limit order.

The 4 hour chart is showing that the price has respected the Fibonacci .618 retracement of the most recent swing and my momentum indicator is rolling over.

The hourly chart shows a clear rising wedge and I have entered at the bottom of the wedge, at the first re-test of the trend line after the price broke through. My macd indicator is showing a bearish divergence with price.

My stop is just outside the top of the wedge and I've placed my first target limit order.

Thursday, March 22, 2012

CHF/HUF targets met

My CHF/HUF long trade has met all 3 profit targets and is now closed for a net RRR of 1: 1.75.

This is a nice example of a falling wedge working out well.

Wednesday, March 21, 2012

EUR/JPY Stopped out

My EUR/JPY short trade has just met its target BUT...not before stopping me out this morning!...

This is one of the hazards of trading. This is an instance where the AB=CD and the Fibonacci level didn't turn out well for me. Subsequent to being stopped out, the price has met all 3 of my profit targets so I will take the positives pout of this and move on.

This is one of the hazards of trading. This is an instance where the AB=CD and the Fibonacci level didn't turn out well for me. Subsequent to being stopped out, the price has met all 3 of my profit targets so I will take the positives pout of this and move on.

CHF/HUF Update

My CHF/HUF trade has broken out of the falling wedge and made good progress. It didn't quite make the first target but got 75% of the way to it. In these instances, I move my stop to break even so that I don't endure the pain of seeing a profit turn into a loss if the trade doesn't make further upward progress. I am therefore in a risk free trade from here on.

Tuesday, March 20, 2012

EUR/JPY Short Trade

I am short the EUR/JPY. The set up is on the hourly chart and is an AB=CD within a channel.

I entered at the "D" point which is just inside the channel. The purple boxes on the indicators show a divergence between the indicators and price. I have placed my stop further outside the channel so it is above the 1.272 Fibonacci extension which I hope will give me some extra protection if the price spikes through the channel. This means I simply reduce my trade size so that my £ risk is within my money management strategy.

I entered at the "D" point which is just inside the channel. The purple boxes on the indicators show a divergence between the indicators and price. I have placed my stop further outside the channel so it is above the 1.272 Fibonacci extension which I hope will give me some extra protection if the price spikes through the channel. This means I simply reduce my trade size so that my £ risk is within my money management strategy.

CHF/HUF Long Trade

AUD/JPY - Short trade

I've entered a new short trade on ADU/JPY this morning. There is divergence between price and indicator on the daily chart and I've taken my entry set up on the 4H chart which has just broken down through a rising wedge. I've entered on a retest of the underside of the wedge.

The 4H chart shows macd not supporting the price rise and the price action is showing a rounded top formation. One area of concern is the previous resistance level just below my entry which may become support. This may prove that I should have waited to enter below this level...I will have to wait and see. My stop order and first target limit order are in place in accordance with my money management strategy.

Amlin - short trade update

My short term trade in Amlin (AML:LSE) hit it's first target level yesterday but failed to reach the second. I am encouraged by my macd indicator showing bearish divergence to the price action so am going to hold out for the second target and will re-asses later today.

Friday, March 16, 2012

Closed short trade for a quick 5.5% profit

I have just closed my "quick short trade" from yesterday on RKH:LSE, 2 minutes before the market closes. The price has made good progress towards the resistance level but the indicators on the short term chart are beginning to turn.

It's Friday afternoon...I've made 5.5% profit in 24 hours and don't want to leave that exposed to the vagaries of the market on Monday morning so on the basis that a profit isn't a profit until it's in your account....I've taken the money and run!. My net RRR was a respectable 2:1.

It's Friday afternoon...I've made 5.5% profit in 24 hours and don't want to leave that exposed to the vagaries of the market on Monday morning so on the basis that a profit isn't a profit until it's in your account....I've taken the money and run!. My net RRR was a respectable 2:1.

Short Trade - Amlin PLC

I have now gone short on Amlin PLC (AML:LSE). I am taking the trade based upon the daily chart but with my entry and stop being based on the hourly chart. The daily chart has been trading in a channel since October 2011 and this was broken to the downside on 5th March. However, the price has now retraced to re-test the lower channel line. There is also a channel on the 1 hourly chart and the price is within a few pips of the top of this channel. Note that there is a bearish divergence on my MACD indicator (orange lines) where the indicator is making a lower low and the price is making a higher high. I am placing a very tight stop on this trade and that may stand me in good stead for a high RRR trade.

Market geometry at work

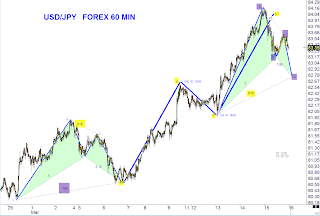

Here is a good example of Fibonacci ratios at work in the currency market. The first pattern on the left is a Gartley pattern showing A-C swing as a .618 retrace and the X-A swing as a .786 retrace. The next pattern is the large AB=CD and you can see that the price action turned within 12 pips of the projected completion at D. The third pattern is another Gartley this time showing a projection to the completion point of a small AB=CD at a .618 retrace of the previous swing.

Thursday, March 15, 2012

A new short term, short trade

Today, I have gone short of Rockhopper Exploration RKH:LSE, for what I hope will be a quick in and out trade. The price has already hit my first target at 351 for a RRR of 1:1.

So....why short a share that has had such a strong move up? The share has had a good run recently but appears to be stalling at the Fibonacci .618 level of a much larger swing on the weekly chart.

The price action appears to be forming a descending triangle pattern and the price has rejected the top side four times now. (It could also be creating a symmetrical triangle which could be a continuation pattern and would not be good for my trade). There have been two strong, above average volume days in March and they have both been down days. I take this as a bearish implication. In cases like this I like to enter as near to the top of the traingle as possible. In this case, if the trade is favourable, I can be out with a 2:1 RRR before the price hits the bottom of the triangle, which I suspect will be an area of strong resistance. (It could also be the neckline of a head and shoulders pattern...but that's another story!) Furthermore...there is divergence between price and momentum on MACD . There is also a potential AB=CD pattern completing at the .618 retracement of the previous swing. This is well below my target and I will monitor price action as the trade proceeds. In any event, I have applied my money management strategy and the trade will play itself out.

AUUCAD Stopped out with a profit

The remaining part of my AUD/CAD short trade was stopped out overnight with with a small profit. This gives me a total RRR of 2.1 t0 1, which is very acceptable. My trailing stop was intentionally tight as 10 of the last 12 days were "down days" and a bounce can therefore be expected.

Wednesday, March 14, 2012

AUD/CAD Update

This trade is going well.....my first target has been met, I've taken some profits and my stop on the remaining portion has been moved to a profit position so that I am now in a risk free trade.

I will continue to monitor the price action and act accordingly but I am now running a 40 pip trailing stop and hope that will enable me to ride the trade all the way down towards the bottom of the weekly wedge.

I will continue to monitor the price action and act accordingly but I am now running a 40 pip trailing stop and hope that will enable me to ride the trade all the way down towards the bottom of the weekly wedge.

Tuesday, March 13, 2012

AUD/CAD Short Trade

I am short the AUD/CAD pair from yesterday. The pattern is a rising wedge on the daily chart (magenta lines) which has formed within a larger rising wedge on the weekly chart (blue lines), going back to November 2009.

Entry was at the break of the daily wedge and my first target will be RRR 1:1. If that is reached I shall hold the remainder of the position hoping for it to reach the bottom of the weekly wedge. The price action today may be showing that the retest of the lower wedge line has taken place and if so, I would expect further price deterioration from here.

Entry was at the break of the daily wedge and my first target will be RRR 1:1. If that is reached I shall hold the remainder of the position hoping for it to reach the bottom of the weekly wedge. The price action today may be showing that the retest of the lower wedge line has taken place and if so, I would expect further price deterioration from here.

Thursday, March 08, 2012

EUR/USD Update

I implemented my "indicator trailing stop strategy" and closed this trade late last night for 1 pip profit! ( after coming home from the West Ham v Watford game).

You can see the magenta coloured lines on price and on the macd. This was indicating a bullish divergence between the indicator and price and whilst I love divergence in the direction of the my trade, I hate it when it is against the direction of my trade. So for those are are avid trend traders....there was a trade which was in the same direction as the weekly, daily and hourly trend and it failed.......that's the market for you!

Wednesday, March 07, 2012

Geometry in the Market - Amazon weekly chart

This is a good example of geometry working in the market...in particular....the AB=CD pattern giving projected levels for a potential reversal of price.

You can see that the orange AB leg formed between October 2008 and April 2010. The price then retraced until July 2010, before continuing its upward path. At this point, the CD leg can be projected to create an "area of interest", in both price and time.

The blue AB leg formed between between June 2010 and Feb 2011 then retraced. Therefore in Feb2010, it was possible to make a second projection which created a second "area of interest" in price and time.

Obviously, these areas of interest are not places to go blindly short but they create a zone where, if you are long, you might want to tighten up your stops and if you are short, you may.

Some traders would use either of the "C" points to look to enter long on the assumption that the trend is continuing.

Note how the price turned exactly at the blue "D"

A new short position on Playtech

I placed a buy a sell stop order on PTEC:LSE and have been filled at 303p. This is a simple triangle trade which sometimes indicates a continuation of the previous trend. However, in this instance, the price was struggling to make a clean break through the .618 level and there was divergence on the macd and convergence on the stochastic. Importantly, the weekly chart has been in a down trend since March 2010. This morning, the price has already re-tested the lower line of the triangle (which often happens) and appears to have been rejected ...but I will have to wait and see how this plays out

EUR/USD

I've taken a short position on the EUR/USD this morning. The daily chart has been in a clear downtrend since Aug 2011 so I am interested i short positions on the shorter time frame charts. The 1 hour chart shows a very clear down trend since 29th February and with the price action sitting at the top of the channel, I am able to enter a short position with my stop VERY close to my entry position. That offers me a large potential RRR (reward to risk ratio). My first target will be the middle channel line (which coincides with the Fibonacci level .786 of the previous upswing) and my second at the bottom channel line. You may note that there is divergence between the price and stochastic indicator - you can see a "step" on the and I like trading these as I believe they show a change in momentum of the participants. I also prefer to see divergence on the macd indicator ...but you can't have everything!

S&P Finally retraces

So...the US stock indices finally took a tumble yesterday. I was short the S&P 500 index from 1370 and remain short with half my position and stop at break even. I feel that we need a bigger market correction to give us the opportunity for some better long set-ups but we will have to wait and see. You can see from the chart that the market turned (almost to the penny) at the completion of a large AB=CD pattern reaching back from early October 2011 ). That along with the bearish divergence between price and indicators (red lines) was a strong signal to me that the market was topping. Moving on I would like to see a retrace to the Fibonacci .618 level (1264) but given how strong this bull market has been, I am initially looking for a retrace to the Fibonacci .382 (1307) level of the most recent swing. If it reaches this level, I will re-appraise my projections in the light of the price action immediately preceding. You can see that the price action retraced to the .618 of the two previous swings and given that the markets have a tendency to repeat themselves over and over again, the .618 level is definitely not out of the question. My only current long trade (VOD:LSE) suffered slightly but my gains on the S&P more than made up for that.

Saturday, March 03, 2012

Vodafone : - VOD:LSE

I took a long position in Vodafone on Friday. Vodafone has been creating a volatility funnel since Sept 2007 and there is another volatility funnel forming on the daily chart. This is the pattern I am trading. However, instead of taking a traditional breakout entry at the top of the spout part of the funnel, I have taken an entry at what I hope is the bottom on the spout. This, of course, is a higher risk entry but it also increases the reward to risk ratio dramatically if it works out. My risk is 6% of the entry price or 10p per share.

When I take this lower entry, I always place my stop just below the bottom of the previous swing low, in case the funnel spout has not actually formed yet and my entry was premature. At the bottom of the previous swing low I would want to be out of the trade in any event.

I am encouraged to take this trade by the following:-

1). Volatility funnel on weekly chart with the smaller volatility funnel on the daily chart.

2). There is a bullish divergence between my stochastic indicator and the price.(red line) and a second converging cross of the oversold line

3). There is a bullish divergence between my macd indicator and the price. (red line)

4). The 200 ma has been moving slightly upwards since 7th Feb, appears to be supporting the price and is sitting in between the .618 and .786 fib ratios.

5). A candlestick tweezer bottom was made on the previous two days and the price has rejected that same level again.

When I take this lower entry, I always place my stop just below the bottom of the previous swing low, in case the funnel spout has not actually formed yet and my entry was premature. At the bottom of the previous swing low I would want to be out of the trade in any event.

I am encouraged to take this trade by the following:-

1). Volatility funnel on weekly chart with the smaller volatility funnel on the daily chart.

2). There is a bullish divergence between my stochastic indicator and the price.(red line) and a second converging cross of the oversold line

3). There is a bullish divergence between my macd indicator and the price. (red line)

4). The 200 ma has been moving slightly upwards since 7th Feb, appears to be supporting the price and is sitting in between the .618 and .786 fib ratios.

5). A candlestick tweezer bottom was made on the previous two days and the price has rejected that same level again.

EUR/CHF Update (4)

I was stopped out at break even on this trade. I don't like to stay in breakout trades for so long as I did in this one.....but, as I said previously, with the stop at break even...it's a free trade.

BT Broadband

I've been without my broadband service from BT since Tuesday. It was restored today (midday Saturday).

Unfortunately, I have to report that the customer service I received from BT (and in particular their off-shore call centre) and only be described as atrocious!...

I will be moving my broadband account this week as I have no desire to deal with a Company who appear to have little or no regard for their customers........lots of hollow sound bites......and that's about it. Given time, they can only hang themselves and end up with no customers other than those that have no choice but to deal with them.

I called up their chart this morning and was staggered to see how much progress their share price has made since February 2009....I've set an alert close to the 0.618 Fibonacci level (230p)and if it gets to that level...I'll be shorting it very aggressively.

Unfortunately, I have to report that the customer service I received from BT (and in particular their off-shore call centre) and only be described as atrocious!...

I will be moving my broadband account this week as I have no desire to deal with a Company who appear to have little or no regard for their customers........lots of hollow sound bites......and that's about it. Given time, they can only hang themselves and end up with no customers other than those that have no choice but to deal with them.

I called up their chart this morning and was staggered to see how much progress their share price has made since February 2009....I've set an alert close to the 0.618 Fibonacci level (230p)and if it gets to that level...I'll be shorting it very aggressively.

Subscribe to:

Posts (Atom)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+1.jpg)